Stranded Assets or Diamonds in the Rough?

Diminishing deal flow requires firms to innovate in their sourcing approach. A recent SPS analysis concluded that PE portfolio companies are being held for an above-average period – which may reveal a treasure trove of attractive hidden deals for scrappier sponsors.

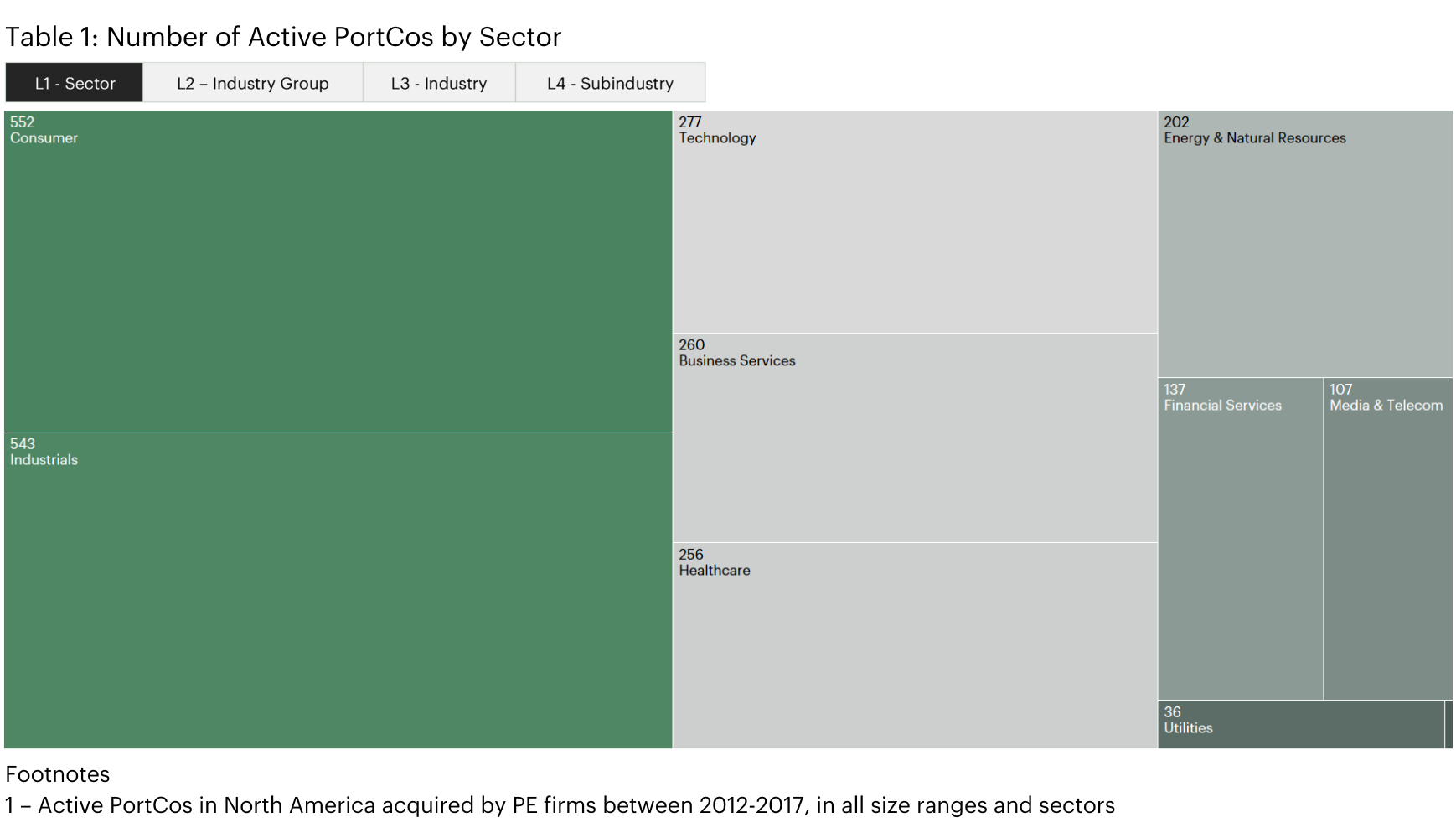

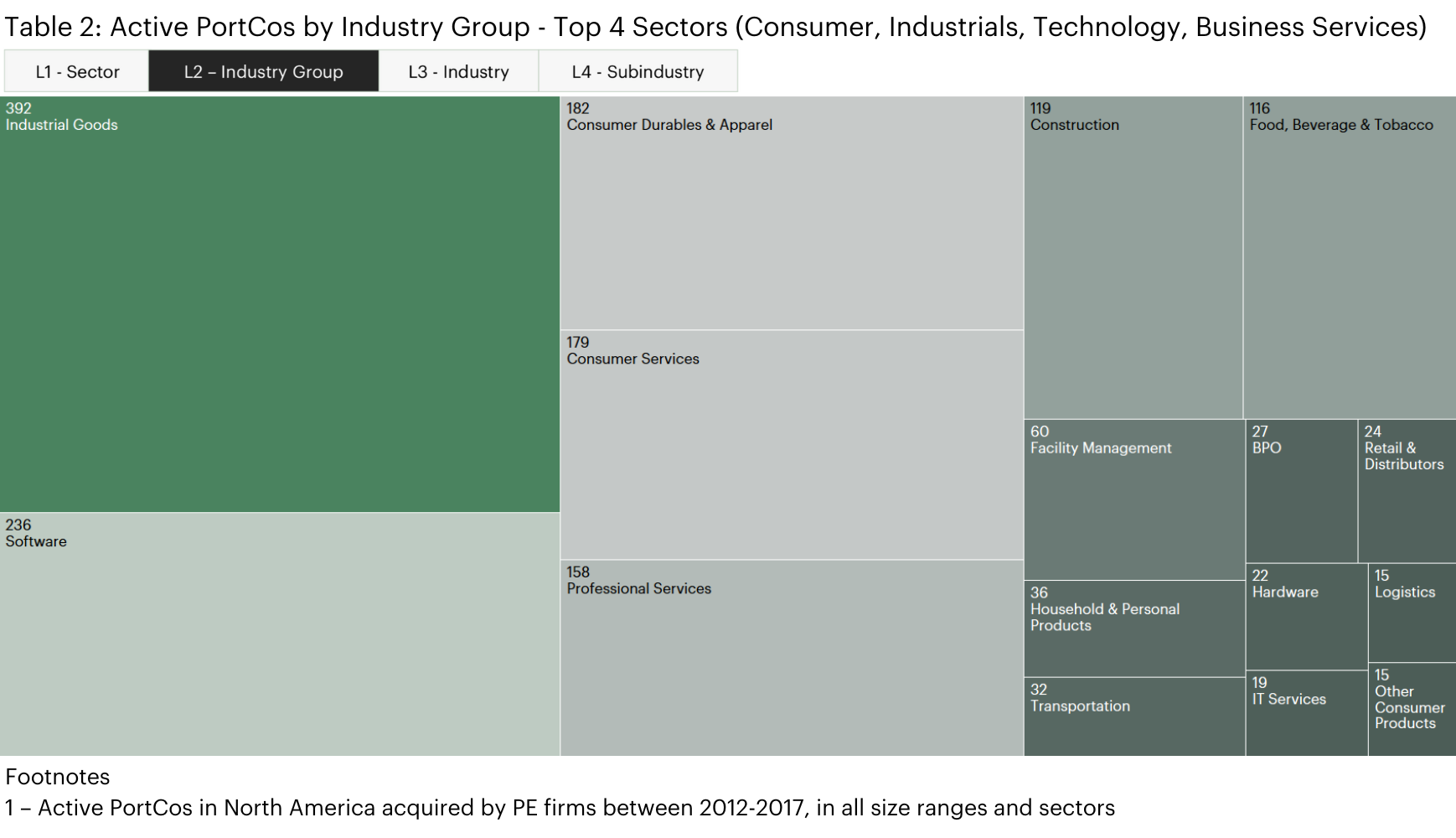

According to SPS data, the quantity of active portfolio companies in most industries has significantly increased, with many being held for over six years. Table 1 below analyzes active portfolio companies acquired by PE buyers between 2012 and 2017 by Sector, while Table 2 evaluates portfolio holdings acquired in the same period by Industry Group in the top four sectors – Consumer, Industrials, Technology, and Business Services.

Holding periods have reached unprecedented highs across the M&A world, with the average holding period for PE-owned assets settling at approximately 5.2 years in 2023, up from an average of 4.4 years in 2017.

While the constrained exit environment might serve to substantiate slowing deal flow over recent quarters, to investors who aren’t afraid to get their hands dirty it may also represent an opportunity.

For longer-held assets, there is a likelihood that these companies have been distressed, stranded, or otherwise forgotten over recent turbulent years. Sometimes, these may include good companies with a temporary setback such as a lawsuit, an issue with a debt obligation, or other resolvable matters. Oftentimes, there is an urgency on the part of the sponsor to sell and an open mind to price negotiations.

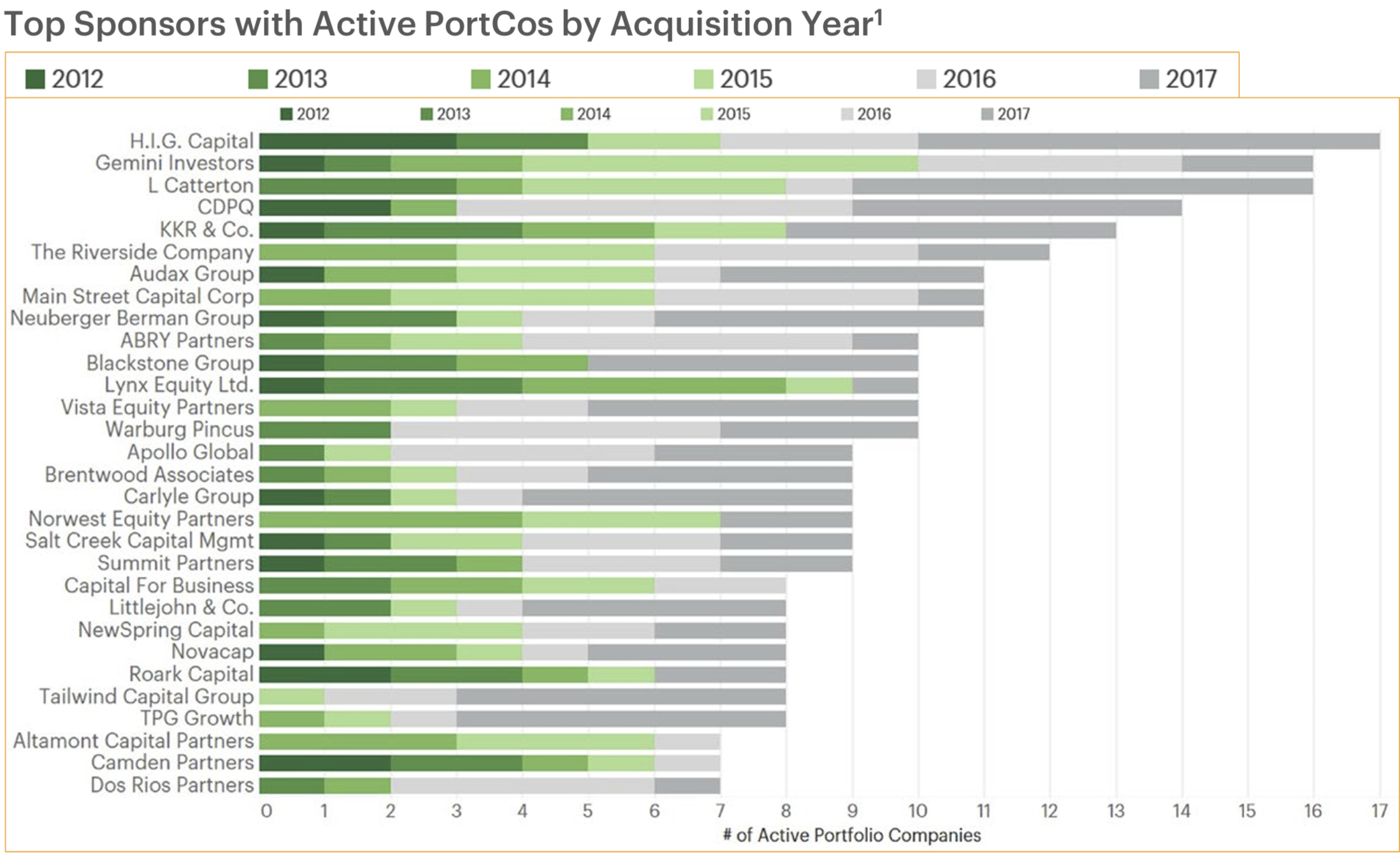

To detect these opportunities, firms can use innovative tools like the SPS Private Equity Harvest functionality to identify attractive companies potentially ready for sale based on vintage and target investment criteria. This suite of product features enables firms to mine distressed assets for diamonds in the rough, find growing assets in need of additional capital, or discover attractive businesses that have demonstrated resilience through economic downturn. Alternatively. firms can prioritize sponsors holding assets for extended periods in their specific target segment.

Find out more about how to leverage SPS capabilities to turn stranded assets into gold in SPS’ latest Private Equity Harvest Report.