Ripe for Exit: Mental & Behavioral Health Providers

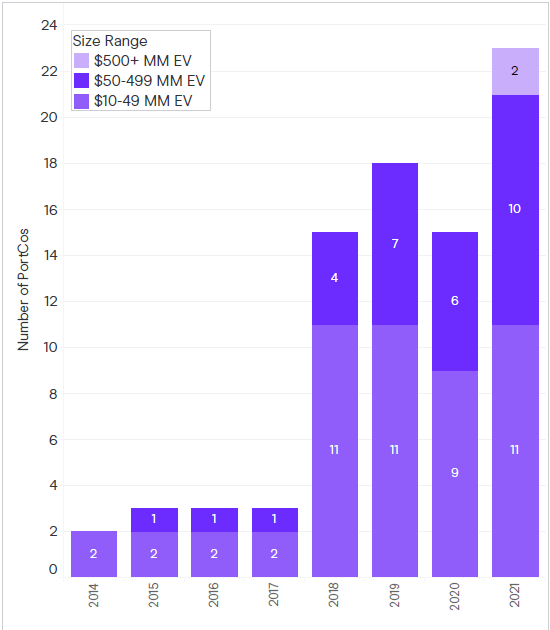

Dealmaking in the mental and behavioral health space continues to grow, even as some other sectors face headwinds. Investor interest—particularly from private equity consolidators—has remained strong, driven by resilient demand and structural shifts in care delivery.