Exits, Fundraising, and AI: Key Insights from Bain’s Mid-Year 2024 Report

After a golden age in private equity, the market has faced a transitional period over the past few years, marked by a significant downturn in deals, exits, and fundraising. Bain & Company’s recent Mid-Year Private Equity Report 2024 provides a detailed analysis of the industry’s performance and offers insights into the emerging trends as the market seeks to regain momentum.

Source Talks ep. 49

Source Talks is a series where we discuss deal origination with PE and M&A pros, in collaboration with David M. Toll.

In this episode, we speak with John Novak, Head of Investment Development and Capital Markets at Paine Schwartz, about the firm’s specific industry focused investment strategy and the importance of technological development.

The Science of Deal Sourcing 101 – 10th Edition: A Market in Flux

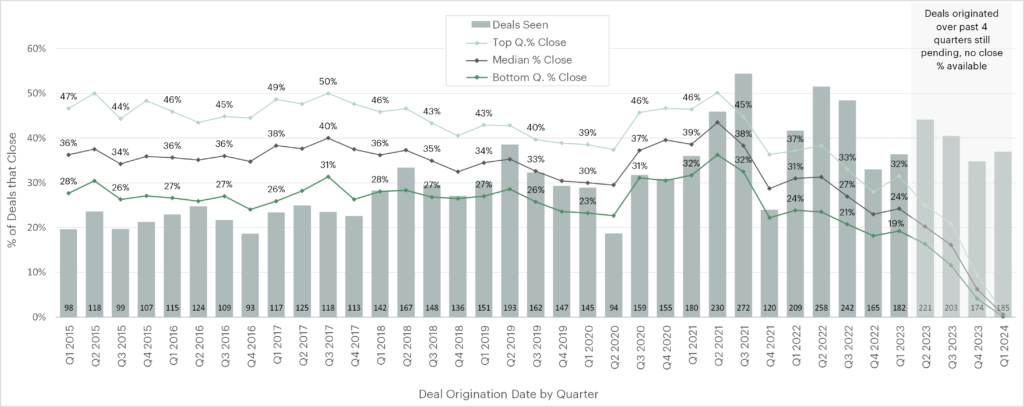

Investor sentiment around private equity deal activity continues to paint a mixed picture. Economic uncertainty, higher-for-longer interest rates, and geopolitical tensions have created an environment of heightened caution. While the two-year decline in deal activity appears to be leveling off, the rebound remains sluggish.

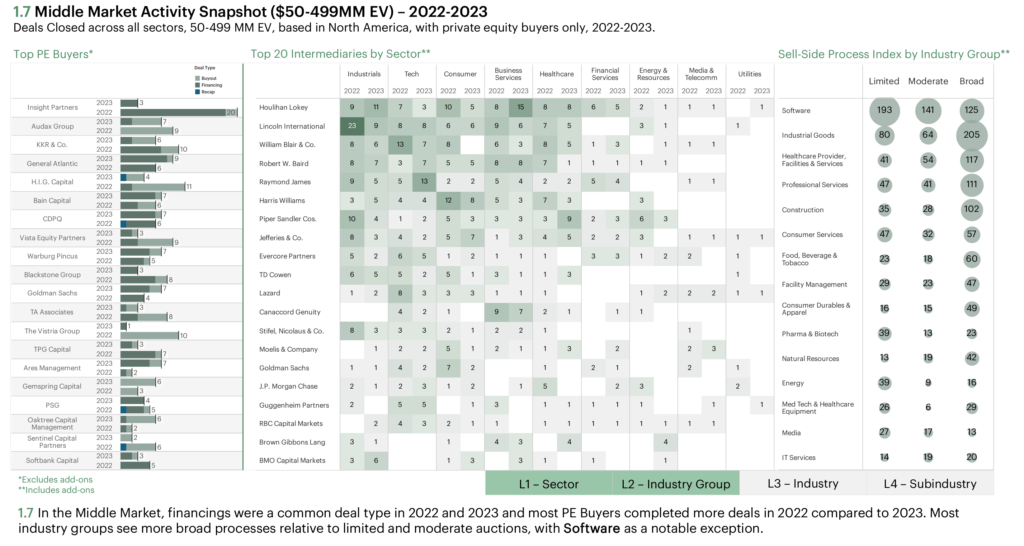

The State of Dealmaking in the Middle Market

SPS by Bain & Co.’s 2024 Deal Sourcing Databook has captured the highs and lows of private equity activity in the last five years, from doldrums in the first year of the COVID-19 pandemic, to heady activity from pent-up demand the following year to another slouch once central bank rates began rising in 2022.