The 12th annual 2024 SPS Deal Origination Benchmark Report (DOBR) has arrived! The report is an annual publication received by each qualifying SPS client comparing its Market Coverage to a peer group of similar private equity firms and the overall industry.

The report provides detailed analysis on each sponsor’s deal sourcing strategy relative to its peers, allowing the firm to gauge its performance and prioritize specific areas for additional focus in the year ahead. It is the industry standard, delivering unparalleled insight into each sponsor’s efficacy for originating deals.

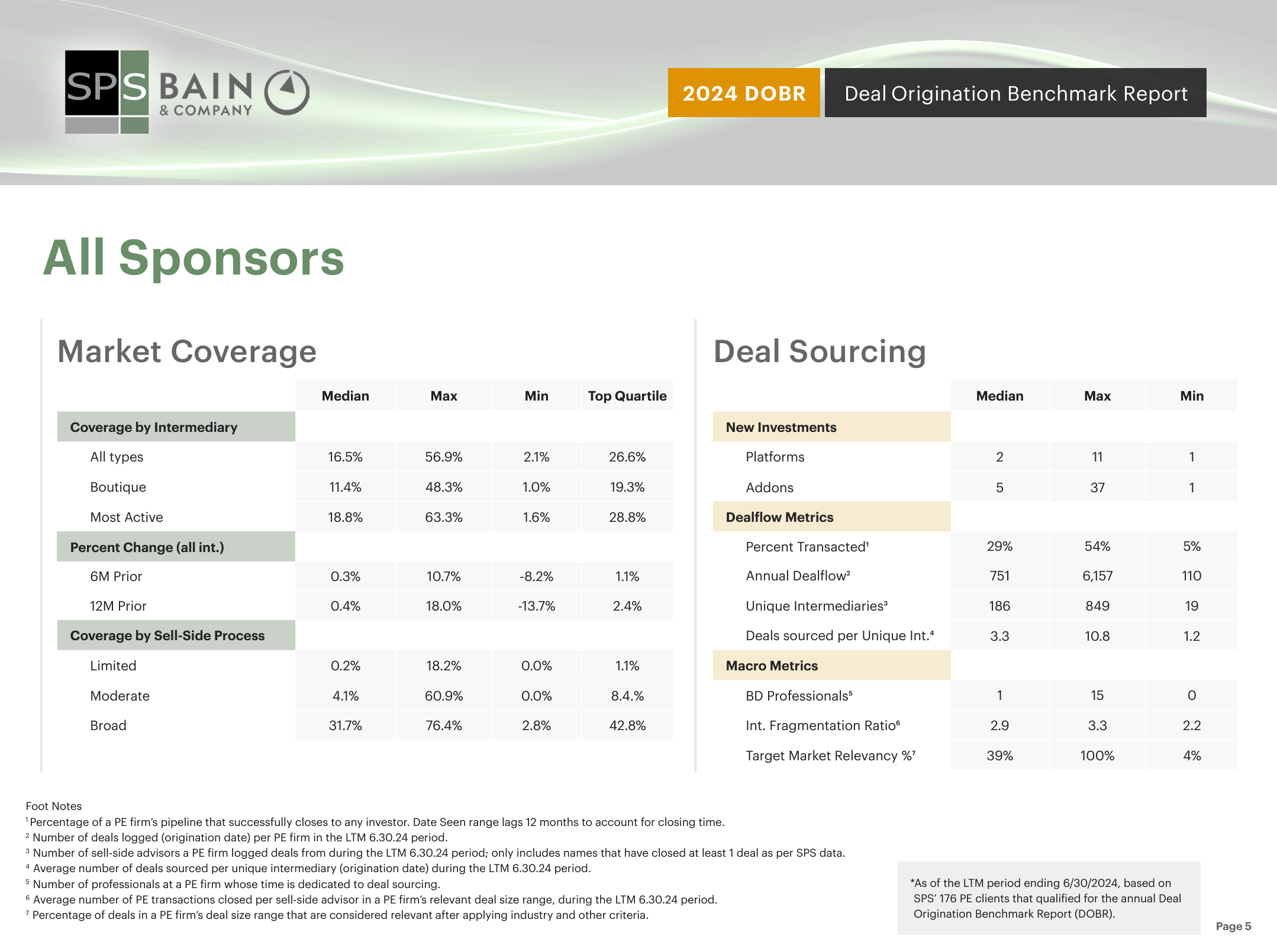

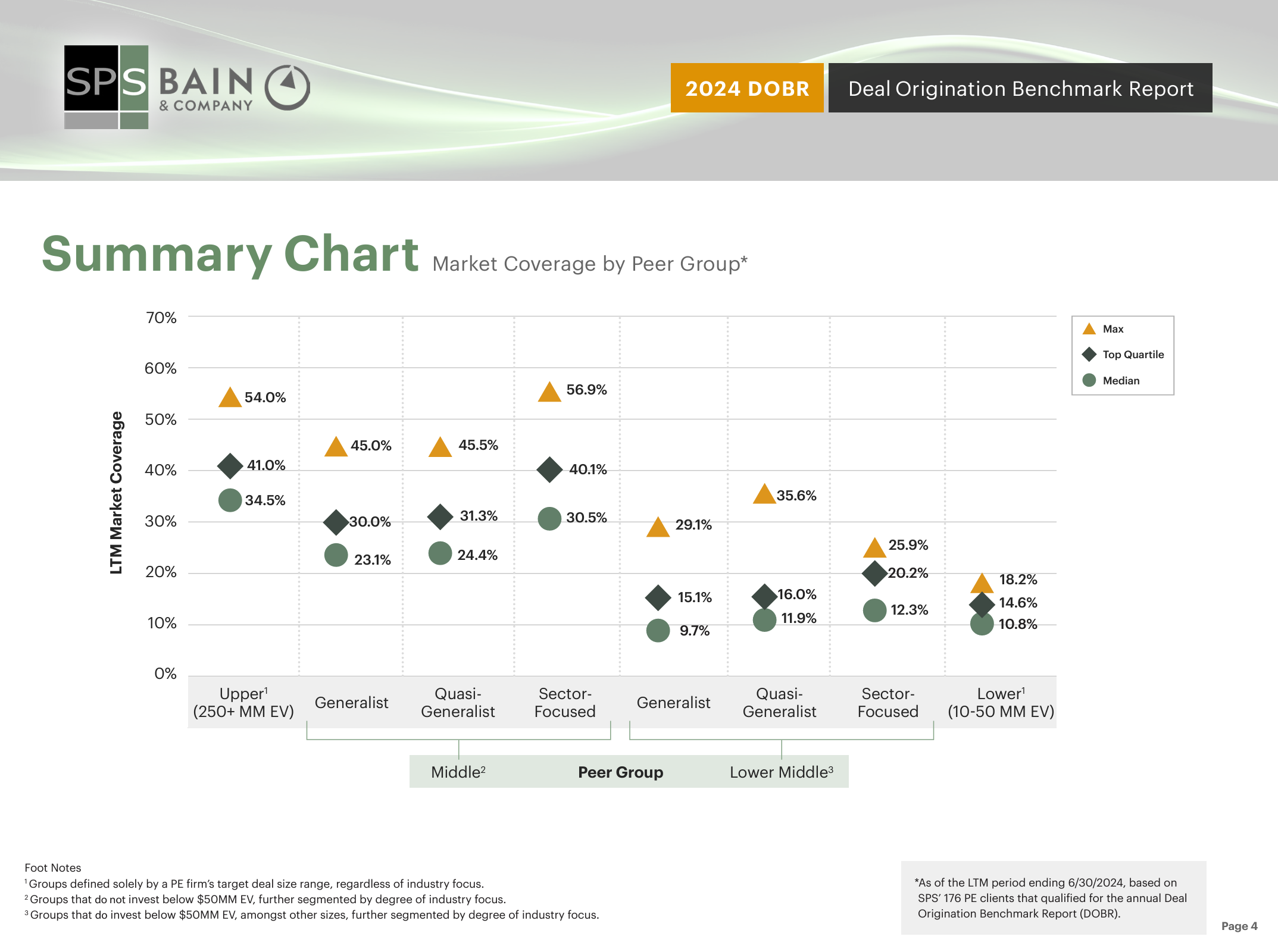

The 2024 edition includes 176 qualified PE firms, segmented into 8 different peer groups. Below are the summary statistics for all sponsors included in the sample.

As private equity faces significant macro challenges, the report reveals critical industry trends enabling firms to successfully navigate shifting deal sourcing dynamics. This year’s edition highlights a modest increase in closed deal activity, though overall deal flow remains constrained. Sponsors continue to face challenges such as lower closure rates, growing deal fatigue, and fewer quality opportunities, but can still capitalize on emerging trends to stay strategic in their sourcing efforts.

Deal Flow on the Rise, But Fatigue Sets In

While the industry experienced a 1.5% increase in overall deal flow, private equity firms are seeing fewer of these deals close, reflecting a challenging environment for deal makers. In fact, the average Time to Close has increased, while the Percent Transacted (the percentage of sourced deals that ultimately close) has decreased by 2% from 2023 and 7% compared to 2022. This is partly attributed to what the industry is calling “deal fatigue,” where both buyers and sellers are worn down by the longer timelines and more complex negotiations.

Market Coverage: A Mixed Bag

The 2024 DOBR reveals that PE firms on average saw only 16.5% of relevant deals that closed in their target market.

This figure remained relatively flat year-over-year, despite a slight increase in median annual deal flow. However, certain segments of the market bucked the trend with modest gains in Market Coverage:

- Generalist, Lower Middle Market: +0.8%

- Sector-Focused, Middle Market: +0.8%

- Lower Market: +0.8%

These niche markets managed to increase their coverage of target market deal despite overall market stagnation.

Add-On Acquisitions Surge

A striking trend in 2024 has been the increase in add-on acquisitions, a hallmark of the popular buy-and-build strategy. As platform acquisition activity remained steady, add-ons have surged, with the median number of deals rising from 3 in 2023 to 5 in 2024—an impressive increase.

Sector-focused firms in the Lower Middle Market tripled their add-on deals from 1 to 3, while Upper Market firms saw their median rise from 8 to 10.

This surge in add-ons speaks to the strategic shift many PE firms are making as they focus on growing existing portfolio companies rather than chasing new platform investments. As central bank rate decreases are anticipated in 2025, this trend could continue to gain momentum.

Selectivity on the Rise

PE firms are becoming more selective, as seen in the 5% year-over-year decline in Target Market Relevancy (the percentage of deals that align with a firm’s investment strategy). This reflects a growing focus on specific sectors or niches as firms narrow their sourcing efforts. As opportunities are limited, PE sponsors are prioritizing quality over quantity, honing in on deals that are more likely to close and align with their strategic goals.

Looking Ahead: Opportunities Amid Challenges

While closing rates are down and deal fatigue is real, PE firms can still find ways to thrive by leaning into the buy-and-build trend and sector specialization. With the US presidential election coming up and potential rate cuts offering renewed momentum for deal-making, further shift is inevitable into 2025. For now, staying strategic and selective is key for firms navigating these uncertain waters.