Download the SPS 2023 Deal Sourcing Databook.

Each year, we publish a collection of market trends, data analysis, and business development themes designed to help private equity firms navigate the ever-variable deal sourcing terrain for the year ahead. Targeted with actionable intelligence, the report offers a granular analysis of market conditions impacting business development today as well as tactical resources to help inform firms’ 2023 origination efforts.

Leveraging our proprietary repository of M&A deal data, we thoroughly examine activity in each sector over recent years and thoughtfully layer evaluations of variables like sell-side process, enterprise value, and deal types to create a toolkit for private equity firms to add to their deal sourcing arsenal for the year to come. The result is a comprehensive, clear, and concise lens into critical insights for PE firms to help devise an effective sourcing strategy in the current M&A environment.

Below are just some of the key findings:

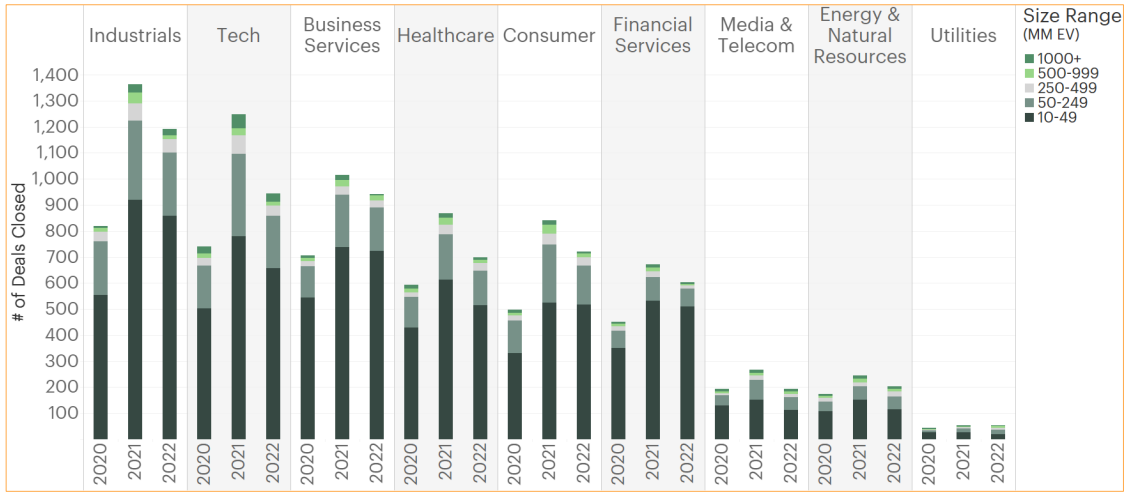

- With a myriad of factors creating an uncertain tone in the market, deal volume has fluctuated dramatically over recent years. A look at deal count by enterprise value (EV) range reveals the $10-50MM EV range has dominated deal counts from 2020-2022.

- Private Equity won 52% of overall market share in 2022, outpacing corporate buyers for the second consecutive year. PE buyers closed a greater share of deals below $250MM EV driven by increased add-on activity, while corporate buyers won in transactions above $250MM EV.

- In terms of sector activity, Industrials, Business Services and Financial Services saw relatively strong 2022 activity compared to the year prior, while Technology and Healthcare deals had the sharpest decline. Despite the Technology sector’s steep drop-off, Software as a sub-sector of Tech had the highest deal count of all Industry Groups in 2022. Industrial Goods followed, with both verticals also seeing higher than average concentrations of deals above $500MM EV.

- 2022 saw an acceleration of the add-on trend as firms turned to smaller, more feasible opportunities amid high market uncertainty. A comparison of sector trends by deal type finds that Financial Services saw the greatest add-on activity relative to other deal types over 2021- 2022, while financings have remained an important investment strategy in the Technology sector during the same period. High deal volume in the most active sectors – Industrials, Technology, Business Services and Healthcare – has been driven by consolidation plays.

- Taking a look at trends in auction processes, the 2022 M&A landscape was more competitive than ever – with about a third of deals in most industries having broad sell-side processes. The shift in some verticals toward broader auctions is no surprise, as firms are prioritizing business development and adopting data-driven sourcing practices, resulting in greater share of mind with target advisors.

- Our analysis shows that PE firms are increasingly selling $1B+ EV deals to corporate buyers, while assets in lower size ranges are largely traded to PE buyers. The portion of $250- 499MM EV deals sold to PE buyers has increased by 10% from 2020 to 2022. Corporate buyers have acquired 12% more deals above $1B EV from PE sellers over the same period. On the sector level, in Healthcare, Financial Services, and Energy sectors, the portion of deals going to corporate buyers significantly increases with higher enterprise values.

The report also includes a Market Mapping section, showcasing functionality within the SPS Portal to tailor the view of relevant opportunities to a firm’s specific investment criteria and pipeline data. Using the Healthcare sector as a proxy, we map out the most active PE buyers, advisors, and senior lenders who are getting deals done. Our Top Missed Cities Report then shows the top locations of the most active Healthcare advisors, using proxy client pipeline data to prioritize the cities where most relevant deals are missed. Clients can further drill down to find the most active intermediaries closing target market deals in their target size range, to prioritize the most productive relationships and go directly to the source for relevant opportunities.

Our PE Harvest Reports examine PE exits by sector and size range, as well as assets that are still being held in firms’ portfolios and are likely to trade again. SPS clients can customize this report to identify targets before they come to market and proactively build relationships with the most relevant players.

For more takeaways from our 2023 Deal Sourcing Databook, download the full report.

To discover how you can leverage SPS data to create more efficiency and productivity in your deal sourcing operation, request an SPS demo.