Ripe for Exit: Mental & Behavioral Health Providers

Dealmaking in the mental and behavioral health space continues to grow, even as some other sectors face headwinds. Investor interest—particularly from private equity consolidators—has remained strong, driven by resilient demand and structural shifts in care delivery.

Building a Data-Driven BD Strategy: What Today’s Top PE Firms Are Tracking

In a deal environment marked by more competition, longer hold periods, and rising expectations from LPs, business development can no longer run on relationships and intuition alone.

Private equity firms are increasingly turning to data-driven strategies to improve sourcing efficiency and sharpen their competitive edge—but success depends on more than just collecting data. It’s about knowing which metrics matter and using them to inform high-impact decisions.

Middle Market Momentum: A Strategic Play for Private Equity in 2025

As private equity firms recalibrate sourcing strategies for 2025, the middle market stands out as a sector of renewed interest and untapped opportunity. Often overlooked in favor of larger transactions, middle-market assets are proving to be not only more resilient but also highly actionable for firms seeking scalable growth with manageable risk.

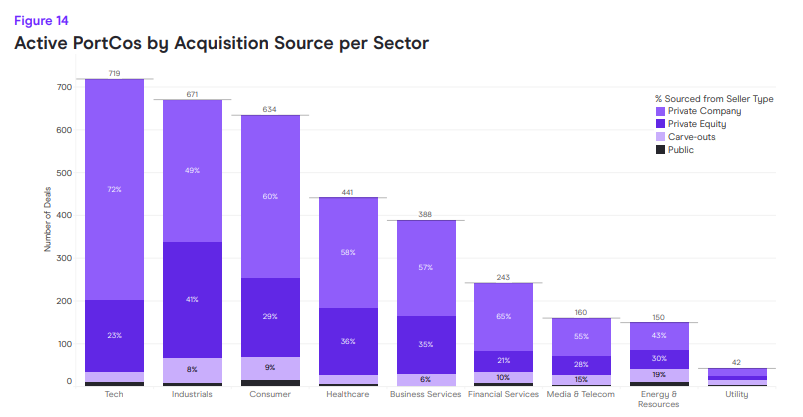

Shifting Deal Sources & Creative Exit Strategies: Key Insights from the 2025 PE Harvest Report

As private equity firms enter 2025, traditional deal-sourcing methods are no longer enough. The SPS 2025 Private Equity Harvest Report reveals critical insights into portfolio holding trends, evolving exit strategies, and shifting buyer-seller dynamics, helping firms refine their sourcing approach in a rapidly changing market.

“With a record supply of PE assets primed for exit, there’s no shortage of opportunity. Whether you’re a sponsor, strategic, lender, or advisor, viable deals are out there—if you know where to look.” — Brenden Gobell, Managing Director

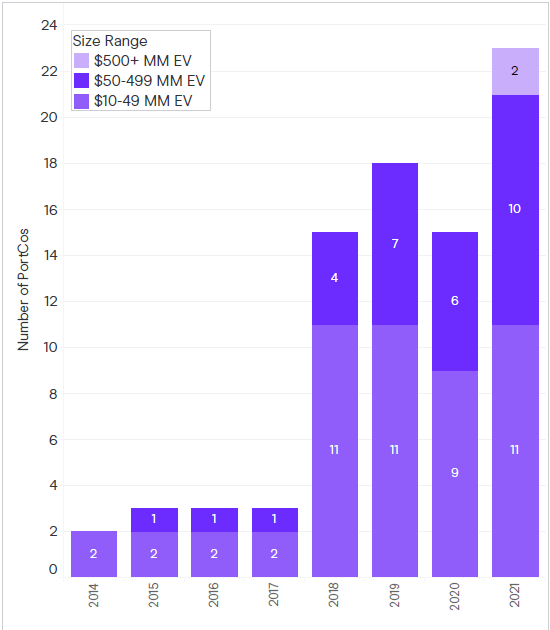

The backlog of 7,400+ PE-backed companies still held from 2014-2021 acquisitions underscores the growing importance of strategic deal sourcing. With holding periods extending and sponsors re-evaluating exit strategies, firms that can identify high-quality, actionable assets will be best positioned to capitalize on this evolving market.