Mezzanine Market Perspective

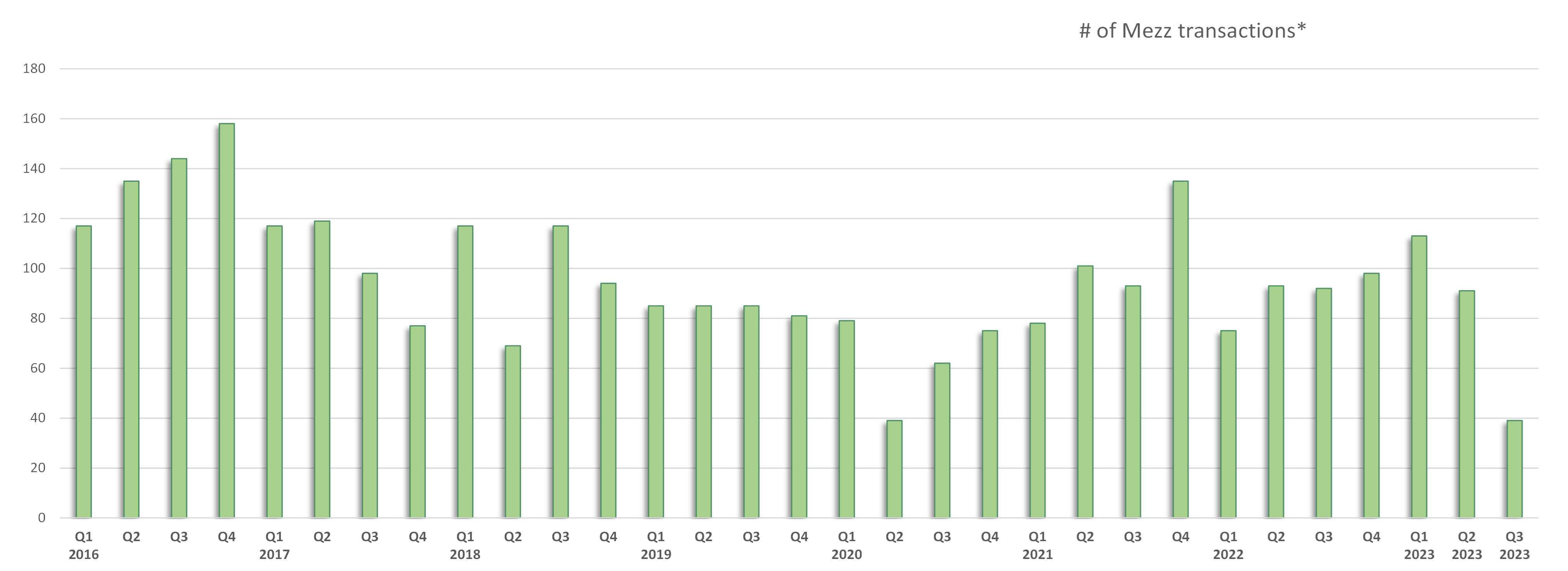

The perspective focuses on market trends and transaction in the mezzanine space and is released quarterly. It also provides data pertaining to transaction activity on a quarter-by-quarter basis going back to Q1 2012.

Q3 2024

In Q2 2024 109 deals including mezzanine debt closed, a 6% decrease from the 116 mezzanine deals closed in Q1 2024. First half mezzanine activity increased approximately 2% YoY from 220 deals in 2023, to 225 deals in 2024. Private equity deal volume for the same period mirrored the modest increase in mezzanine deal activity, increasing 1% from 2,561 deals in 2023, to 2,582 deals in 2024. Out of the 107 mezzanine deals that closed in Q2 2024, 37 deals were buyouts, 51 were minority financings, 19 were sponsor-backed add-ons, and 2 were recaps. The most common industries in total M&A activity for the quarter were Technology, Industrials, Business Services, and Consumer, respectively.

Browse Past Reports

Q3 2024

Q2 2024

In Q1 2024, Mezzanine activity for the LTM period ending March 31st increased approximately 11% YoY from 414 deals to 460 deals. Compared to Q4 2023, deals including mezzanine debt decreased 31%, from 162 to 112 in Q1 2024. Mirroring the downturn, private equity deal volume declined 14% from 1,453 deals in Q4 2023 to 1,245 deals in Q1 2024. Out of the 112 mezzanine deals that closed in Q1 2024, 33 deals were buyouts, 59 were minority financings, and 20 were sponsor backed add-ons. The most common industries in total M&A activity for the quarter were Industrials, Technology, Business Services, and Consumer, respectively.

Q1 2024

In Q4 2023, 151 deals including mezzanine debt closed, a 76% increase from the 86 deals closed in Q3 2023. Mezzanine activity during 2023 increased approximately 22% YoY from 371 deals to 454 deals. Despite this increase, private equity deal volume decreased 14% YoY from 6,022 deals in 2022, to 5,164 deals in 2023. Out of the 151 mezzanine deals that closed in Q4 2023, 59 deals were buyouts, 60 were minority financings, 31 were sponsor-backed add-ons, and 1 was a recapitalization. The most common industries in total M&A activity for the quarter were Technology, Industrials, Consumer, and Business Services, respectively.

Q4 2023

In Q3 2023, 82 deals including mezzanine debt closed, a 13% decrease from the 94 mezzanine deals closed in Q2 2023. Mezzanine activity through the first three quarters of the year increased approximately 9% YoY from 268 deals in 2022, to 293 deals in 2023. Despite the increase in mezzanine deal activity, private equity deal volume for the same time period decreased 18% from 4,487 deals in 2022, to 3,679 deals in 2023. Out of the 82 mezzanine deals that closed in Q3 2023, 33 deals were buyouts, 27 were minority financings, and 22 were sponsor-backed add-ons. The most common industries in total M&A activity for the quarter were Technology, Industrials, Business Services, and Healthcare, respectively.

Q3 2023

In Q2 2023 91 deals including mezzanine debt closed, a 20% decrease from the 113 mezzanine deals closed in Q1 2023. 1H mezzanine activity increased approximately 21% YoY from 168 deals in 2022, to 204 deals in 2023. Despite the increase in mezzanine deal activity, private equity deal volume for the same time period decreased 18% from 2,950 deals in 2022, to 2,412 deals in 2023. Out of the 91 mezzanine deals that closed in Q2 2023, 38 deals were buyouts, 27 were minority financings, and 26 were sponsor-backed add-ons. The most common industries in total M&A activity for the quarter were Technology, Industrials, Consumer, and Healthcare, respectively.

Q2 2023

Mezzanine activity for the LTM period ending March 31st decreased approximately 3% YoY from 401 deals to 387 deals. Compared to Q1 2022, deals including mezzanine debt increased 39%, from 74 to 103 in Q1 2023. Despite the increase in mezzanine deal activity, private equity deal volume declined 22% from 1,518 deals in Q1 2022 to 1,183 deals in Q1 2023. Out of the 103 mezzanine deals that closed in Q1 2023, 38 deals were buyouts, 44 were minority financings, 19 were sponsor-backed add-ons, and 2 were recapitalizations. The most common industries in total M&A activity for the quarter were Technology, Industrials, Business Services, and Consumer, respectively.

Q1 2023

Mezzanine activity during 2022 decreased approximately 8% YoY from 396 deals to 366 deals. Compared to the previous quarter (Q3 2022), deals including mezzanine debt increased, from 93 to 97 in Q4 2022. The increase in mezzanine deal activity inversely correlates with the decrease of private equity sponsored deal volume, which decreased 2% from 1,573 deals in Q3 2022 to 1,536 deals in Q4 2022. Out of the 97 mezzanine deals that closed in Q4 2022, 45 deals were buyouts, 27 were minority financings, 20 were sponsor-backed add-ons, and 5 were recapitalizations. The most common industries in total M&A activity for the quarter were Technology, Industrials, Business Services, and Consumer, respectively.

Q4 2022

Mezzanine activity for the LTM period ending September 30th increased approximately 12% YoY from 335 deals to 375 deals. Compared to the previous quarter (Q2 2022), deals including mezzanine debt slightly increased, from 86 to 87 in Q3 2022. The slight increase in mezzanine deal activity correlates with the slight increase of private equity sponsored deal volume, which increased 3% from 1,329 deals in Q2 2022 to 1,368 deals in Q3 2022. Out of the 87 mezzanine deals that closed in Q3 2022, 43 deals were buyouts, 26 were minority financings, 16 were sponsor-backed add-ons, and 2 were recapitalizations. The most common industries in total M&A activity for the quarter were Services, IT, Healthcare, and Industrial, respectively.

Q3 2022

Mezzanine activity for the LTM period ending March 31st increased approximately 54% YoY from 241 deals to 371 deals. Compared to the previous quarter (Q4 2021), deals including mezzanine debt decreased from 129 to 59 in Q1 2022. Mezzanine activity for the LTM period ending June 30th increased approximately 19% YoY from 304 deals to 363 deals. Compared to the previous quarter (Q1 2022), deals including mezzanine debt increased from 65 to 78 in Q2 2022. The increase in mezzanine deal activity inversely correlates with the decrease of private equity sponsored deal volume, which decreased nearly 11% from 1,412 deals in Q1 2022 to 1,259 deals in Q2 2022. Out of the 78 mezzanine deals that closed in Q2 2022, 46 deals were buyouts, 14 were minority financings, 14 were sponsor-backed add-ons, and 4 were recapitalizations. The most common industries in total M&A activity for the quarter were IT, Services, Healthcare, and Financial, respectively.

Q2 2022

Mezzanine activity for the LTM period ending March 31st increased approximately 54% YoY from 241 deals to 371 deals. Compared to the previous quarter (Q4 2021), deals including mezzanine debt decreased from 129 to 59 in Q1 2022. The decrease in mezzanine deal activity correlates with the decrease of private equity sponsored deal volume, which decreased nearly 26% from 1,840 deals in Q4 2021 to 1,366 deals in Q1 2022. Out of the 59 mezzanine deals that closed in Q1 2022, 28 deals were sponsored buyouts, 12 were minority financings, 15 were sponsor-backed add-ons, and 4 were recapitalizations. The most common industries in total M&A activity for the quarter were IT, Services, Healthcare, and Financial, respectively.